Page 35 - Layout 1

P. 35

BUSINESS OF

MEDICINE

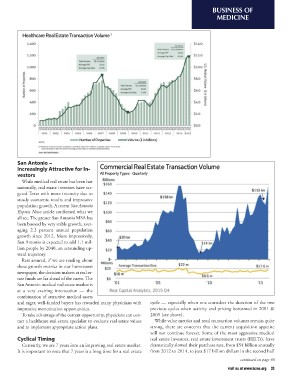

San Antonio – cycle — especially when one considers the duration of the two

Increasingly Attractive for In- previous cycles when activity and pricing bottomed in 2001 &

vestors 2009 (see above).

While medical real estate has been hot While value metrics and total transaction volumes remain quite

nationally, real estate investors have tar- strong, there are concerns that the current acquisition appetite

geted Texas with more intensity due to will not continue forever. Some of the most aggressive medical

steady economic results and impressive real estate investors, real estate investment trusts (REITs), have

population growth. A recent San Antonio dramatically slowed their purchase rate, from $54 billion annually

Express News article confirmed what we from 2012 to 2014, to just $17 billion dollars in the second half

all see. The greater San Antonio MSA has

been buoyed by very stable growth, aver- continued on page 36

aging 2.2 percent annual population

growth since 2012. More impressively, visit us at www.bcms.org 35

San Antonio is expected to add 1.1 mil-

lion people by 2040, an astounding up-

ward trajectory.

Rest assured, if we are reading about

these growth metrics in our hometown

newspaper, the decision makers at real es-

tate funds are far ahead of the curve. The

San Antonio medical real estate market is

at a very exciting intersection — the

combination of attractive medical assets

and eager, well-funded buyers has rewarded many physicians with

impressive monetization opportunities.

To take advantage of the current opportunity, physicians can con-

tact a healthcare real estate specialist to evaluate real estate values

and to implement appropriate action plans.

Cyclical Timing

Currently, we are 7 years into an improving real estate market.

It is important to note that 7 years is a long time for a real estate