Page 34 - Layout 1

P. 34

BUSINESS OF

MEDICINE

Capitalizing on Value in

healthcare’s New Reality

By Jon Wiegand

Associate Member, Healthcare Practice Group

Cushman & Wakefield in San Antonio

Email at jwiegand@sacadvisors.com, or office (210) 585-4911,

mobile (210) 241-2036, fax (210) 824-1840.

Healthcare providers are leading dual lives. In one pursuit, years Reduced Reimbursements

of education and training have sharpened the abilities that physicians As if intended to counteract the good news for physicians and

put to use each and every day. Physicians strive to optimize the pa-

tient care mission and simultaneously need to achieve financial re- their owned real estate, we are continually reminded that the future

turns commensurate with years of intense training and delayed of physician reimbursement is murky at best. The Affordable Care

gratification. However, as business owners, physicians are required Act has increased access to care, but has also contributed to substan-

to make significant decisions that fall outside the typical ‘scope of tial headwinds aimed at reducing provider reimbursements. A recent

practice.’ report detailed that the U.S. healthcare system (including govern-

ment and private payers) spent 5.5 percent more on healthcare in

Whether owned or leased, a practice’s real estate will have a sub- 2015 than in 2014. Not only does this represent a net increase in

stantial impact on the physician’s business strategy and personal year-over-year spending, but, astoundingly, it also represents a more

goals. There is currently an incredible window of opportunity for accelerated growth rate than 2014’s 5.3 percent increase.

physicians with owned real estate, enabling them to capture previ-

ously unachievable values for their medical real estate Given the continued increase in overall healthcare spending, re-

imbursement reductions are likely to continue. Furthermore, it is

Europe’s ‘Brexit’ and America’s made-for-TV presidential cam- near impossible to envision a scenario when providers will receive

paign race have dominated recent headlines. Between these and pay raises from CMS and/or private insurers. Therefore, physicians

other volatile events, the broader markets have experienced tremen- must consider other avenues to create value and generate returns to

dous instability. The combination of international chaos and histor- counteract the reduction in medical practice compensation.

ically low yields from traditional

investment avenues has forced capital to

seek returns in real estate.

A Focus on healthcare

Real Estate

In an effort to further safeguard against

future downturns, increasing numbers of

real estate investors are aggressively pursu-

ing healthcare real estate. With interest

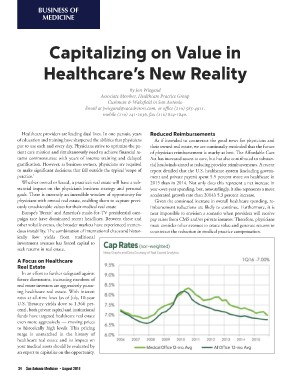

rates at all-time lows (as of July, 10-year

U.S. Treasury yields dove to 1.366 per-

cent), both private capital and institutional

funds have targeted healthcare real estate

even more aggressively — moving prices

to historically high levels. This pricing

surge is unmatched in the history of

healthcare real estate and its impact on

your medical assets should be evaluated by

an expert to capitalize on the opportunity.

34 San Antonio Medicine • August 2016